Separate self assessment and PAYE systems and a lack of current software seem to be at the heart of these HMRC mistakes with P800 calculations.

What’s gone wrong with the P800 calculations?

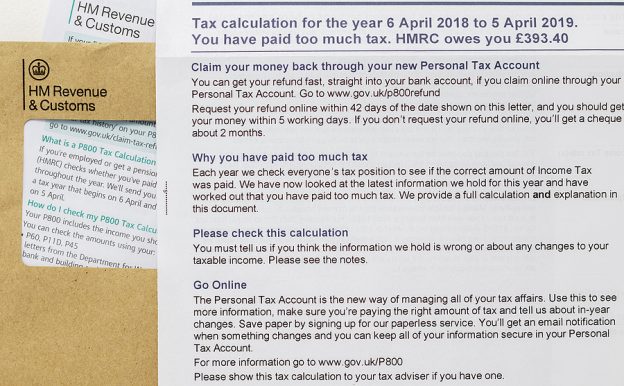

The tax legislation states that HMRC must apply tax reliefs and allowances to the advantage of the taxpayer, not the Treasury. Multiple cases of a discrepancy between self assessment and P800 calculations have been found by tax professionals, software developers and professional bodies in the industry. All brought to them by their confused clients.

This has uncovered the fact that this law is not being universally applied.

And this is partly down to a systems error. An HMRC spokesperson said: “PAYE and Self Assessment are managed on separate HMRC systems, so calculations operate independently for each. To protect customers from the risk of receiving an incorrect PAYE calculation we pro-actively identify those who may be affected and calculate their correct tax position manually.”

This explains why an individual taxpayer has different figures on their self assessment and P800. But why?

Of course, the HMRC staff working on PAYE know that they’re not following the legislation to apply tax reliefs and allowances in the taxpayers’ favour. But basically, the software isn’t compatible.

HMRC does say: “If a P800 calculation is inadvertently issued without correctly allocated allowances or reliefs we will act quickly to correct the issue as soon as it is brought to our attention. We are actively exploring opportunities to deliver a technical solution to prevent this risk.”

And, digging deeper…

Tim Good, Director of Absolute Software, looked into the details of why calculations based on exactly the same figures have different results.

It’s based on how the Personal Allowance is applied. He says: “Legislation has always required personal allowances and relief to be allocated in the most favourable way to the taxpayer. Until we discovered it, HMRC’s calculator allocated them using the same hierarchy as the allocation to the rate band: non savings income; savings income; and dividends.”

This worked fine, but should have been altered to accommodate new legislation in 2016. That’s when then Chancellor Osborne brought in the dividend income allowance, personal savings allowance and the personal savings rate band. Which makes the previous method of calculation inaccurate.

Good concludes: “I guess they didn’t get the memo about the updated calculation. I don’t care if the errors are to the Revenue’s or the taxpayers’ advantage. All I’m concerned with is let’s just get the calculation right.”

This has been going on since the 2016-17 tax year, so you need to go back and check your P800 calculations from then until the 2020-21 tax year. Now HMRC has rectified the specification. Better late, than never.

So, should I keep checking my P800 calculations?

Yes, definitely. HMRC makes mistakes, just like the rest of us. The ultimate responsibility for your tax compliance is on you. So double-check everything you can.

Obviously, you can’t assess the accuracy of HMRC’s software. And Rebecca Cave, consultant tax editor for AccountingWEB sees this recent issue as further evidence that there needs to be regulation governing tax software.

She said: “HMRC cannot be bothered to correct its software, so people have been overpaying tax for years. Even if it’s £10 or £100, it’s still not what the law says. All of this could be avoided if there was an independent and competent third party that checked HMRC’s specification and spreadsheet against the tax law before it was released to developers.”

Perhaps this kind of independent overseer will feature in HMRC’s future to the benefit of everybody.